Credit Score Improvement

The credit report repair process involves identifying and addressing inaccuracies, outdated information, or negative items on a credit report that may be affecting an individual's credit score. The first step is obtaining a copy of the credit report from major credit bureaus (like Experian, TransUnion, and Equifax) to thoroughly review the details. Common errors may include incorrect personal information, outdated account statuses, or inaccurate payment histories. Once errors are identified, the individual or a credit repair service disputes these items directly with the credit bureaus, providing evidence to support the corrections.

The bureaus are required to investigate disputes, typically within 30 days, during which they verify the information with creditors. If the dispute is valid, the erroneous data is corrected or removed, and the updated report is sent to the individual. Besides dispute resolution, the credit repair process may also involve negotiating with creditors to remove certain negative items, such as late payments or charge-offs, in exchange for payment. Over time, consistent on-time payments, reducing outstanding debt, and maintaining a healthy credit mix also help improve the credit score, making credit repair a gradual process that requires diligence and persistence.

Process Onset:

When initiating the credit report repair process, certain documents and information are required to identify errors, file disputes, and support claims. Here’s a list of essential documents and information needed:

-

PAN Details

-

Aadhar Details

-

Mobile Number

-

E-Mail ID

-

Negative Account Documents/Information

Service Request Number

Tracking Customer Service & History

Efficient Workflow Management

Accountability

Historical Reference

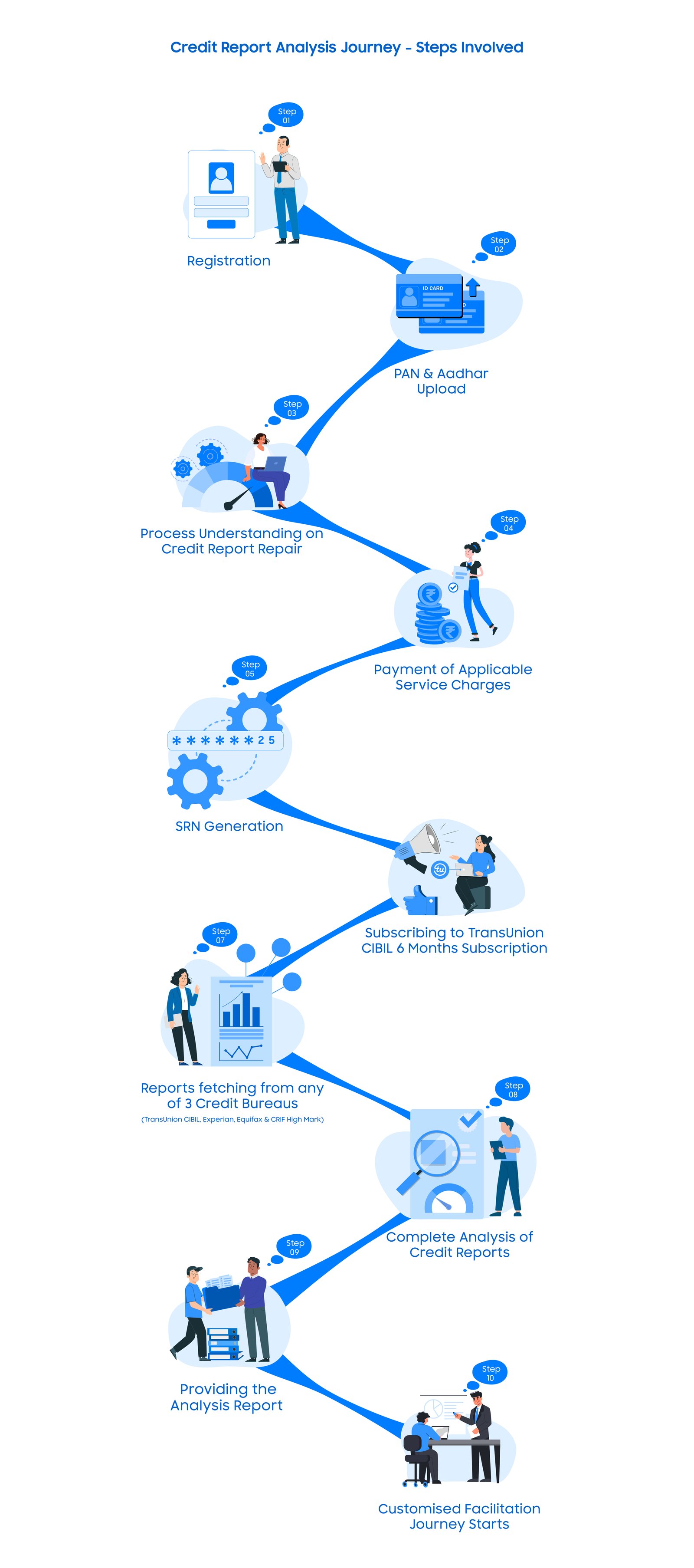

SRN Registration Process at Crediple

At Crediple, the registration of an SRN may follow these steps

Customer Initiation

The customer registers at crediple.com with a

service request regarding their credit.

System Logging

The system logs the request in Crediple’s Customer Relationship Management (CRM) to generate the unique SRN.

Acknowledgment

The SRN is communicated to the customer, often via email or SMS, to confirm that the request has been logged.

Tracking and Updates

The SRN is used by both the customer and the internal team to track the progress of the request, with periodic updates sent to the customer.

Resolution and Closure

Once the issue or service request is served, the SRN is marked as "CLOSED," and the customer is informed of the outcome.

This process ensures seamless service delivery and effective communication between Crediple and its clients.

Credit Reports Review

The credit report repair process involves reviewing an individual's credit report for inaccuracies, errors, or negative items that may be lowering their credit score. It starts by obtaining credit reports from the three major credit bureaus—Equifax, Experian, and TransUnion CIBIL — to ensure a comprehensive review. Common errors include incorrect personal information, wrongly reported late payments, outdated account statuses, or accounts opened fraudulently. Once these inaccuracies are identified, the Crediple files formal disputes with the credit bureaus, providing documentation to support the claims.

The bureaus are legally required to investigate the disputes, typically within 30 days. They will contact the creditors involved to verify the accuracy of the disputed information. If the information is proven to be incorrect, the bureaus will correct or remove the item from the report. Additionally, steps like negotiating with creditors to remove certain negative items (such as late payments or settled accounts) may also be part of the process. Over time, responsible credit behaviour, such as making on-time payments and reducing outstanding debts, further improves credit scores. Credit report repair is thus a structured, methodical process aimed at correcting errors and improving an individual’s financial standing.

Our Process

Building great future Together, Be with us

Continuous Monitoring

A subscription allows individuals to monitor their credit reports regularly. This is crucial for identifying any new errors, fraudulent activity, or incorrect information as soon as it appears. Without a subscription, accessing reports is often limited to once annually, which could delay addressing issues that negatively impact credit scores.

Frequent Updates

Credit reports are updated periodically, reflecting new data from creditors, such as payment histories, credit inquiries, or changes in account status. With a subscription, individuals can track these changes in real-time and verify whether corrections from previous disputes have been made. This ongoing access helps ensure that disputes lead to permanent corrections.

Timely Dispute Resolution

Having immediate access to updated reports through a subscription enables quicker dispute resolution. Instead of waiting for annual reports or paying for each report individually, subscribers can detect inaccuracies early and file disputes more promptly, speeding up the credit repair process.

Improved Financial Health

Regular access to credit reports empowers individuals to take charge of their f inancial health. They can make more informed decisions, such as when to apply for loans or credit cards, based on the most current credit data. Monitoring credit closely also helps in identifying the impact of credit building strategies and adjusting them as needed.

Enhanced Security Against Fraud

A subscription helps detect signs of identity theft or fraud, such as unauthorized accounts or credit inquiries, early on. This is critical for protecting personal finances and ensuring that fraudulent activities are promptly removed from the credit report.

Professional Credit Repair

For credit repair companies, having a subscription to multiple credit bureaus is vital to provide clients with comprehensive services. It allows them to track changes across all major bureaus and dispute incorrect information on behalf of clients in a more systematic and efficient manner.

In summary, subscribing to a credit bureau is essential for both individuals and credit repair services to keep a close eye on credit reports, ensure accurate information, and facilitate a smooth and effective credit repair process.

Credit Report Fetching

Fetching a credit report from multiple credit bureaus—typically Equifax, Experian, and TransUnion CIBIL — are crucial for ensuring a comprehensive crediple.com and accurate understanding of one’s credit standing. Here’s why obtaining reports from multiple credit bureaus is important for credit report repair and f inancial management

Inconsistencies Between Bureaus

Credit bureaus may have different information because not all lenders report to all bureaus. Some creditors may report to just one or two, leading to discrepancies in the data. For instance, an account may appear on one report but not on another. By pulling reports from multiple bureaus, you can identify these inconsistencies and take steps to correct them.

Complete Picture of Credit History

No single credit bureau report provides a full overview of an individual's f inancial history. Creditors may report different types of credit activity (e.g., loans, credit cards, collections) to different bureaus. Fetching reports from all major bureaus ensures you have a comprehensive view of your credit history, which is critical for accurate credit repair and decision-making.

Varied Credit Scores

Credit scores calculated by different bureaus can vary because they use different scoring models and because each bureau may have slightly different information about your credit activity. Reviewing credit reports from all three bureaus helps you understand these variations and monitor your scores more effectively.

Targeted Dispute Resolution

If errors or negative items appear on one bureau’s report but not on others, it is essential to file disputes with the specific bureau where the error exists. Pulling reports from multiple bureaus ensures that disputes are targeted and specific, allowing you to clean up your credit across all reports and not just one.

Lender-Specific Preferences

Different lenders may use reports from different bureaus when assessing credit applications. For example, one lender might rely on Experian, while another might prefer Equifax. By having reports from all major bureaus, you can ensure you know what each lender might see, helping you make informed financial decisions and anticipate credit outcomes.

Protection Against Identity Theft

Reviewing reports from multiple bureaus helps in detecting signs of identity theft or fraud more effectively. A fraudulent account might appear on one bureau's report but not on others. Early detection across multiple reports allows you to address fraudulent activity before it spreads and causes further damage to your credit.

Broader Dispute Success

Credit bureaus conduct their own investigations, and the outcome of a dispute can vary across bureaus. A successful dispute with Equifax may not automatically correct the same issue with Experian or TransUnion CIBIL. Fetching credit reports from all bureaus ensures you can follow up on disputes with each bureau independently, increasing the chances of successful credit repair.

Credit Improvement Opportunities

Different bureaus may report different credit limits, payment histories, or account statuses, which can impact your credit score. By reviewing all reports, you can identify specific items to focus on improving, such as reducing debt-to-credit ratios or addressing late payments, which might be reflected differently on each bureau’s report.

Credit Report Analysis

A complete credit report analysis involves a detailed review of all components within a credit report to assess a person's financial health, identify areas for improvement, and rectify any inaccuracies or negative items. This process is essential for understanding how various factors impact a credit score and for taking the necessary steps to improve it. Here’s a comprehensive breakdown of what a complete credit report analysis entails

Collections accounts occur when an unpaid debt is sold to a collection agency. These have a substantial negative impact on credit scores. The analysis will:

- Identify any accounts sent to collections.

- Confirm whether the accounts were valid or if they were inaccurately reported.

- Look into possibilities for settling or disputing these accounts.

Derogatory marks include serious negative items like:

- Charge-offs: Debts the creditor has written off as a loss.

- Settlements: Where less than the full amount was paid.

- Repossession: For items like vehicles due to failure to make payments.

An analysis will highlight these marks and recommend steps to dispute or remove them, such as negotiating with creditors or using credit repair services.

The credit report shows the variety of credit accounts, which can include:

- Revolving Credit: Such as credit cards.

- Instalment Loans: Such as mortgages, car loans, and student loans.

- Retail Accounts: Store-specific credit cards.

Having a healthy mix of different types of credit accounts is beneficial for a good credit score. The analysis checks whether there’s a balanced credit mix and identifies opportunities to improve this if needed.

Though not directly shown on credit reports, analyzing the relationship between total debt and income is crucial in understanding one’s overall f inancial health. This is particularly important when planning to apply for new credit or loans. A high DTI can indicate financial strain, even if credit scores are relatively healthy.

The report will often include credit scores from different bureaus. The analysis looks at:

- Differences between scores from Equifax, Experian, and TransUnion CIBIL.

- The factors influencing the score (e.g., high utilization, missed payments, derogatory marks).

- Opportunities for improving the score through specific actions (e.g., reducing debt, disputing errors, or building positive credit behaviour).

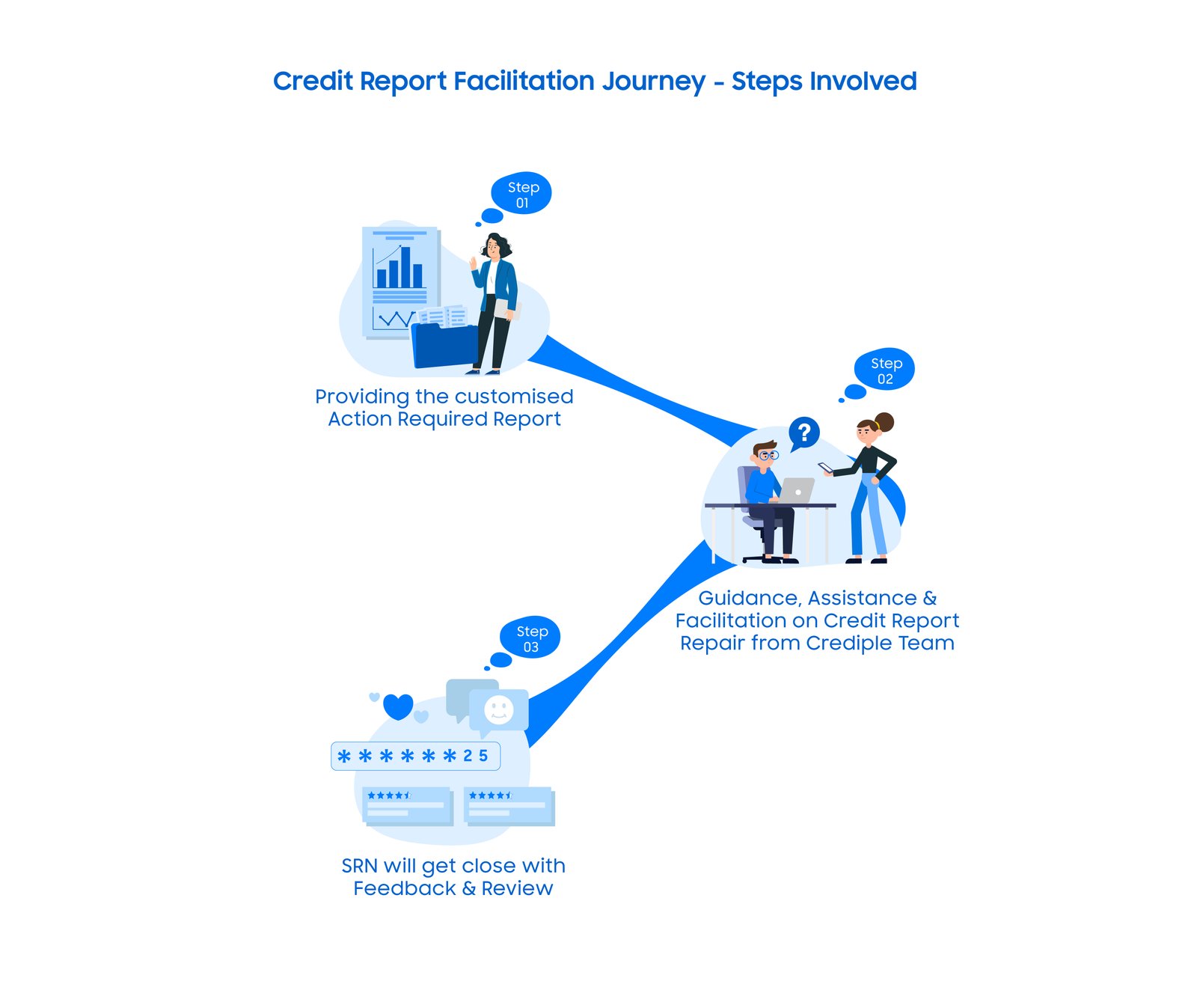

After a thorough analysis, the final step is to create an Action Required Plan based on findings. This may include:

- Disputing inaccuracies or errors with the credit bureaus.

- Negotiating with creditors to remove negative marks (e.g., late payments, charge-offs).

- Paying down high credit card balances to reduce credit utilization.

- Setting up payment plans for delinquent accounts.

- Limiting new credit applications to reduce hard inquiries.

The first step in a credit report analysis is verifying that all personal information is correct. This includes:

- Full Name (and any aliases or previous names)

- Current and Previous Addresses

- Permanent Account Number

- Date of Birth

- Employment & Income History

The report contains detailed information about all credit accounts, including:

- Open Accounts: Current active accounts such as credit cards, loans, and mortgages.

- Closed Accounts: Accounts that have been paid off or voluntarily closed.

- Account Types: Whether the account is a revolving credit (credit cards) or instalment credit (mortgages, car loans).

- Account Status: Whether the account is in good standing, delinquent, or has been charged off or sent to collections.

Payment history is a major factor in credit scores and includes records of on time or late payments for each account. A complete analysis involves:

- Identifying late payments, missed payments, or defaulted accounts.

- Confirming payment patterns—were any payments wrongly reported as late?

- Disputing inaccurate information, such as incorrectly reported missed payments, which can significantly hurt credit scores.

Credit utilization refers to the percentage of available credit used at any given time and is a key factor in credit scores. The analysis looks at:

- Credit Limits: Are they reported accurately?

- Current Balances: Are balances high compared to available credit?

- Utilization Ratio: Is the total utilization over 30% (a threshold that can negatively impact credit scores)?

Credit reports list inquiries that occur when a lender checks your credit report for a loan or credit application. Inquiries are categorised as:

Hard Inquiries: These affect your credit score and occur when you apply for new credit.

Soft Inquiries: These do not affect your score and are often associated with background checks or pre-qualification offers.

Analysing the number and frequency of hard inquiries is important because too many inquiries in a short time can lower credit scores. The analysis will also check for unauthorized or fraudulent inquiries, which can indicate identity theft.

Any public records related to financial obligations, such as:

- Bankruptcies

- Tax Liens

- Judgments

- Foreclosures These records can severely impact a credit score, and the analysis should ensure that such records are accurate and not older than the allowed reporting period (e.g., seven to ten years for bankruptcies).

A complete credit report analysis is a vital tool for improving financial health. It offers a detailed assessment of a person’s credit history, identifies issues that may be hurting their credit score, and provides actionable steps to repair and enhance their credit standing. Whether done individually or through a credit repair service, it’s essential for anyone aiming to achieve better financial stability and access to favorable lending terms.